If you're looking to save money on purchasing a house, foreclosures are a great way to go. However, there are still very costly mistakes that buyers can make. Not knowing what Government Programs are available There are many government assistance programs available for first time buyers, and owner occupants. These programs can help with both down payment and closing costs. It gets confusing sometimes as to what program works in a given area. Your Realtor, and your Lender can both help you select the right … [Read more...]

Archives for August 2010

How to chose a Luxury Neighborhood

Houston’s finest neighborhoods are governed by strict covenants. Homeowners are expected to abide by the rules. These rules are designed to protect the value of the homes, and the neighborhood. It is a good idea to learn as much as you can about the neighborhood before making a decision. Visit the neighborhood on a week-end when the homeowners will be at home. Stop and visit with your future neighbors. Find out what they like and don’t like about the neighborhood. Find out the demographics … [Read more...]

How to buy a Tax Foreclosure

The Harris County Tax sale resembles a carnival where property listings are auctioned off to pay for taxes owed by the owner. You see Ex-Enron traders, professional home re-modelers, wide eyed novices, and even investors flying in from out of town running madly around a city block with excel spread sheets in their hands. Everyone has their secret formula to success which they are guarding with their lives. The most important thing to realize is that the professionals have figured out a maximum price they will … [Read more...]

Corporate Housing

Houston has furnished, luxury apartments located near our major business centers and luxury neighborhoods. There is an apartment for you no matter how long your stay will be. Contact Bill Edge for a more detailed analysis. Our Free Service includes: A complete list of fully furnished rental housing in Harris County Locations convenient to your work and shopping Pet friendly locations available Work closely with human resource departments Weekly house keeping available Units available with … [Read more...]

Housing Assistance for Veterans in Houston

TEXAS VETERANS LAND BOARD (VHAP) was created in 1846 to proudly serve Texas veterans. The agency offers a wide array of special benefits exclusively for Texa Veterans, including state veterans homes and cemeteries and below-market interest rate loans for land, housing and home improvements. How the Housing Assistance Program Works The Veterans Housing Assistance Program (VHAP) provides financing up to $325,000 toward the purchase of a home to qualified Texas veterans. There is no maximum sales price with the … [Read more...]

How to buy a Bank/Mortgage Foreclosure

Here is what happens after you have picked out a property which happens to be a Bank or Mortgage Company foreclosure. Negotiation Your offer for the property listing needs to be realistic. If the property went on the market yesterday. Then the seller is not going to be too negotiable. If the property has been on the market for six months with no contract offers. Then the seller is going to be very negotiable. Home Warranty Banks and mortgage companies will not pay for a home warranty. Don’t write it in the … [Read more...]

Planning for Home Ownership

1. Determine how much house you can afford. What is your gross annual income? How much outstanding debt do you have? What is your credit score? If you do not know your credit history, request your credit report. 2. Determine eligibility for down payment assistance. Attend a Homebuyer’s Education Class. Which program is best for you? 3. Meet with a lender to pre-qualify for a mortgage loan. If not mortgage ready, work on existing credit score and reducing debt. 4. Call Bill Edge at … [Read more...]

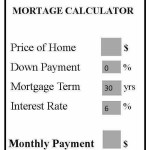

Mortgage Calculator

The mortgage calculator is a financial tool which will help you estimate a home loan amount that you can afford. Based on the amounts you have entered in the fields below: price, down payment, interest rate, and term of the loan. The calculator will tell you what your monthly payments will be. The amount the mortgage calculator gives you should be used as an estimate only of your mortgage payment amount. The calculator gives the buyer the ability to easily see how a change in interest rate can affect their … [Read more...]

FHA Houston Property Inspection List

It is important for both homeowners and buyers to know what a FHA/HUD property appraiser will look for. The FHA states that it "has shifted from its historical emphasis on the repair of minor property deficiencies and now only requires repairs for those property conditions that rise above the level of cosmetic defects, minor defects or normal wear and tear." The FHA inspection covers Safety, Security, and Soundness issues with the home. The age of the home has nothing to do with whether the home will pass or … [Read more...]

How to buy a HUD Foreclosure

The following information will assist you in understanding how to purchase a government-owned home. Anyone can buy a government-home HUD homes can be purchased by anyone. While many of the HUD-owned homes in our inventory are affordable for low to moderate income individuals and families, there is no income restriction on purchasing these homes. However, a buyer must submit a pre-qualification letter from a lending institution or have proof that they can pay cash for the home in order for a bid to be … [Read more...]