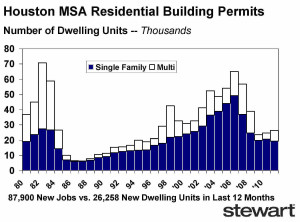

Dr. Ted C. Jones Chief Economist for Stewart Title rates the Houston job market as tops in the United States. Houston added 87,000 new jobs last year with 9,100 jobs added in November 2011. Home sale have been going up for the last 4 months. According to Dr. Jones, Houston has seen the bottom of the market. The current median price for a home is down 25.8% from 2006. There is an increase in multi-family homes as rent prices are increasing. We are building half the number of homes needed by the population and job growth.

This Demand for new homes will turn up this year amid an improving job market and rising apartment rents, a local housing analyst said Wednesday. Builders will start at least 20,000 single-family homes, about a 10 percent increase over 2011 when the new home market stumbled, according to Mike Inselmann, president of Houston-based Metrostudy, a consulting firm to the building industry. “We’re in the midst of an economic recovery,” he said during an annual forecast presentation. “We have the oil and gas industry to thank for that.” Inselmann noted another reason to be hopeful.

Home Building Trends

Number of homes started in the Houston area each year:

| 2000 | 26,233 |

| 2001 | 29,822 |

| 2002 | 33,995 |

| 2003 | 38,160 |

| 2004 | 40,712 |

| 2005 | 47,964 |

| 2006 | 49,543 |

| 2007 | 37,483 |

| 2008 | 26,029 |

| 2009 | 18,549 |

| 2010 | 18,752 |

| 2011 | 18,000-18,500 Est. |

| 2012 | 20,000+ Est. |

In November, area builders sold more homes than they did in the last two Novembers, according to data collected by Metrostudy. A year ago, Inselmann predicted home starts would be up slightly in 2011, but they dipped. Mike Dishberger, CEO and co-owner of Sandcastle Homes, is optimistic about the coming year. He said Houston’s housing market is benefitting from the booming energy industry as more people relocate to this area for work. Consumers are starting to feel more confident, too, he added. “People are out looking for homes. They’re not just window-shopping,” said Dishberger, past president of the Greater Houston Builders Association.

Home Buyers expressed concerns:

Mortgage lending remains challenging, and some consumers are too worried about the direction of the economy to make a big purchase like a house. Interest rates are so low that banks do not want to invest their money. Houston Realtor Bill Edge is seeing more homes sold for cash as tight credit conditions and foreclosed homes continue to plague the Real Estate Market.

A survey of those who attended Metrostudy’s forecast event showed 40 percent believed new home sales will fall this year. If home buying activity does grow this year, rising rents could have something to do with it.

Mega Themes

Residential renting Vs. Owning

Liquidity Trap

Massive uncertainty from Washington DC

Time to Over-Weight in Real Estate

Foreclosures

Houston does not suffer from as great a problem as the rest of the United States. There is a shadow inventory of 1,800,000 homes in the United States which are not on the lenders books today. There are 7,200,000 foreclosed home on the market which are inhabitable. Assuming that defaults continue the number will rise to 11,000,000 homes. We are currently selling 5,500,000 foreclosed homes a year. That means it will take two years for the foreclosure problem to end assuming no major changes.

Landlords’ market

Apartment demand combined with little new construction has made it a landlords’ market, encouraging more renters to buy homes. “We’re beginning to see the pendulum shift toward the economics of homeownership again,” Inselmann said.

Call Bill Edge at 713-240-2949 to see Houston homes in 24 hours or less.

Source: Houston Chronicle January 5, 2012, Ted Jones Chief Economist Stewart Title

Leave a Reply