If you've spent any time in the past few years in the real estate marketplace, then you are well familiar with the current real estate problem. Starting in 2006, the sub prime crisis came to ahead when the real estate market and lending industry realized that years of careless lending were starting to hurt. This led to the foreclosure epidemic, which in turn had a hand to play in the great recession of 2008. This is likely information you are already aware of, but what you may not know is the government's … [Read more...]

Renovation Loans & Lenders Houston 2013

This is the best time ever to get a Renovation loan in Houston. No longer do lenders make the sign of the cross when you mention a renovation loan. In fact there are actually some brave souls who specialize in these loans. Among the best are Jeannie M. West, Ashley Foxhoven, Okley Post, and Diana Johnson. There companies make many of the loan approval decisions in house and fund their own loans. A Renovation loan is a 30 year fixed rate mortgage with a construction loan. The FHA 203K Streamline loan and … [Read more...]

Financial crisis has changed JUMBO LOANS

In the days before the Housing crisis lenders competed for Jumbo loan mortgages. Buyers were able to make documented loans by simply blowing on mirrors. The underwriter would see their breath had fogged the mirror and say they were approved. I had a client would was an Elvis impersonator. He said that he made a minimum of $500 a night and worked a minimum of 200 nights a year. His income tax did not agree with his bank account. No problem, the loan was approved for the full amount. Fast forward to today a … [Read more...]

Housing Assistance for Veterans in Houston

TEXAS VETERANS LAND BOARD (VHAP) was created in 1846 to proudly serve Texas veterans. The agency offers a wide array of special benefits exclusively for Texa Veterans, including state veterans homes and cemeteries and below-market interest rate loans for land, housing and home improvements. How the Housing Assistance Program Works The Veterans Housing Assistance Program (VHAP) provides financing up to $325,000 toward the purchase of a home to qualified Texas veterans. There is no maximum sales price with the … [Read more...]

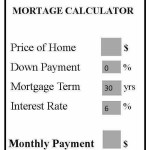

Mortgage Calculator

The mortgage calculator is a financial tool which will help you estimate a home loan amount that you can afford. Based on the amounts you have entered in the fields below: price, down payment, interest rate, and term of the loan. The calculator will tell you what your monthly payments will be. The amount the mortgage calculator gives you should be used as an estimate only of your mortgage payment amount. The calculator gives the buyer the ability to easily see how a change in interest rate can affect their … [Read more...]

Mortgage Lenders

Home ownership in Houston is possible without worrying about massive down payments, because these mortgage lenders offer HUD programs and FHA loans for low to middle income families and those with less than perfect credit. There are jumbo loans and great interest rates for those with excellent credit. Home ownership has never been easier with these dedicated lenders who provide the high quality service you have come to expect from Bill Edge. With competitive rates and fees, they are the trusted Texas … [Read more...]

Get Finances in Order with Free Report

Get Finances in order with Free Report It makes sense to make sure your finances are in order before you start looking for a home. Texas residents will have online access to free credit reports by June, making that process a little easier. The Fair and Accurate Credit Transactions Act of 2003 made it possible for consumers to access free copies of credit reports, which list a consumer’s financial history, including total debt and whether you pay bills on time. The law was designed to help us better monitor … [Read more...]

Credit Scoring Quick Answers

Credit Scoring Quick Answers What does a credit score range from? 300 to 850 What is a good score? 680 and above is considered “A” credit What determines the credit score? 35% payment history (lates, collections, charge-offs, public records) 30% account utilization (balances being carried) 15% length of credit history 10% types of credit (mixture is best) 10% inquiries (only the first ten count) Should a person pay-off their debt? The only debt that should be paid during the loan … [Read more...]

Credit Repair Packet

CREDIT REPAIR PACKET INSTRUCTIONS Step 1: Fill out the three dispute letters below using your personal information for the three specific credit bureaus. Step 2: Make sure you have listed your proper address and contact information Step 3: Sign each document Step 4: Mail each letter individually to the corresponding addresses listed in the packet. One letter should go separately to each of the credit bureaus. Step 5: Repeat Step 3 every 30 days. You will receive an updated credit report from each of … [Read more...]

Grandfather’s Home in West U

I grew up with my Grandparents in West U. The first seven years of my life were spent living with them. Many times I would accompany my grandfather when he left for work at Kay’s Lounge his restaurant/bar on Bissonett. My earliest memories are of sleeping under the bar in a wooden box. And walking around with a baby bottle in my mouth, a cloth diaper falling down. And a handful of dimes in my hand to play the jukebox and the pinball games. I thought baby food was oysters on the half shell. And my favorite milk … [Read more...]